Analyzing GOEV Stocktwits Forum for Canoo Investors

As you navigate the turbulent waters of the stock market, you may find yourself drawn to the electric vehicle sector. One company that’s been making waves is Canoo Inc., trading under the ticker GOEV. If you’re looking to dive deeper into this intriguing stock, you’ve come to the right place. In this article, we’ll guide you through the GOEV Stocktwits forum, where investors and enthusiasts gather to discuss Canoo’s latest developments. You’ll discover key insights into GOEV’s stock charts, analysis, and current trends. So buckle up and get ready to explore the momentum behind Canoo Inc. in the ever-evolving EV landscape.

Overview of Canoo Inc. and GOEV Stock

Introducing Canoo: The EV Innovator

When you’re exploring the electric vehicle (EV) market, you’ll want to take a closer look at Canoo Inc. This innovative company is making waves with its unique approach to EV design and manufacturing. Founded in 2017, Canoo has quickly become a notable player in the automotive industry, catching the attention of investors and EV enthusiasts alike.

Understanding GOEV Stock

As you dive into the world of EV investments, you’ll encounter GOEV – the stock ticker for Canoo Inc. Listed on the NASDAQ, GOEV stock represents your opportunity to invest in Canoo’s vision for the future of transportation. Keep in mind that like many young EV companies, GOEV stock can be volatile, reflecting both the potential and risks associated with this emerging industry.

Key Features of Canoo’s Approach

When you examine Canoo’s business model, you’ll notice several distinctive features:

- Skateboard platform: A versatile foundation that can support multiple vehicle types

- Subscription model: Offering flexibility to consumers beyond traditional ownership

- Unique designs: Vehicles that challenge conventional automotive aesthetics

These innovative approaches set Canoo apart in the competitive EV landscape, potentially influencing GOEV stock performance as the company progresses.

Monitoring GOEV’s Market Performance

As you track GOEV stock, you’ll want to stay informed about Canoo’s milestones, production updates, and financial reports. Keep an eye on factors like:

- Production targets and actual output

- Partnerships and collaborations

- Technological advancements

- Market reception of Canoo’s vehicles

By staying abreast of these elements, you’ll be better equipped to understand the movements of GOEV stock and make informed decisions about your investment strategy in this dynamic EV market.

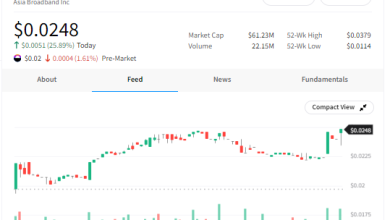

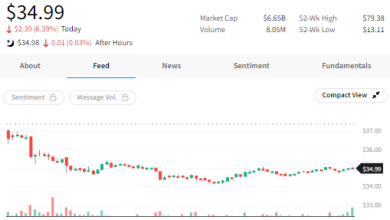

Recent Price Action and Volume Trends for GOEV

Navigating the Stock’s Movements

As you explore GOEV’s recent market performance, you’ll notice some intriguing patterns in both price action and trading volume. Let’s dive into the key trends you should be aware of to make informed decisions about Canoo Inc.’s stock.

Price Fluctuations to Watch

When examining GOEV’s price chart, you’ll see that the stock has experienced significant volatility in recent months. Keep an eye on key support and resistance levels, as these often dictate short-term price movements. You might want to pay close attention to how the stock reacts when approaching these critical price points.

Volume Trends and Their Significance

As you analyze GOEV’s trading activity, don’t overlook the importance of volume trends. Spikes in trading volume often coincide with major price movements or news events. By monitoring these volume patterns, you can gain valuable insights into market sentiment and potential shifts in momentum.

Identifying Key Technical Indicators

To get a comprehensive view of GOEV’s recent performance, you’ll want to consider various technical indicators. Look for patterns in moving averages, relative strength index (RSI), and MACD (Moving Average Convergence Divergence). These tools can help you gauge the stock’s momentum and potential trend reversals.

Correlating Price Action with Company News

As you navigate GOEV’s price action, remember to cross-reference significant movements with recent company announcements or industry news. This approach will help you understand the driving forces behind price fluctuations and make more informed predictions about future trends.

Sentiment and Discussions on GOEV Stocktwits

Navigating the Pulse of GOEV Investors

As you dive into the GOEV Stocktwits forum, you’ll find yourself immersed in a sea of opinions, analyses, and real-time reactions from Canoo enthusiasts and skeptics alike. This platform serves as your window into the collective sentiment surrounding $GOEV stock, offering valuable insights that can help shape your investment strategy.

Deciphering Bullish vs. Bearish Sentiment

When you scroll through the GOEV Stocktwits feed, you’ll notice a mix of bullish and bearish sentiments. To make sense of this information:

- Look for recurring themes in bullish posts, such as excitement about Canoo’s innovative designs or potential partnerships.

- Pay attention to bearish arguments, which might focus on production delays or financial concerns.

- Consider the overall ratio of positive to negative sentiment as a gauge of investor confidence.

Spotting Key Discussion Topics

As you explore the forum, you’ll encounter several hot topics that dominate the conversation:

- Production updates and timelines

- Potential government contracts or major partnerships

- Comparisons to other EV manufacturers

- Technical analysis of GOEV stock charts

By focusing on these areas, you can quickly get up to speed on the most pressing issues affecting Canoo’s stock performance.

Leveraging Stocktwits for Your Research

Remember, while Stocktwits can be a valuable tool in your investment research arsenal, it’s crucial to approach the information critically. Use the platform to:

- Identify potential catalysts that might affect GOEV stock

- Gauge market reactions to news and announcements

- Discover new perspectives or angles you hadn’t considered

By navigating GOEV Stocktwits strategically, you’ll gain a deeper understanding of the market sentiment surrounding Canoo and be better equipped to make informed investment decisions.

Technical Analysis and Indicators for GOEV

As you dive into the world of GOEV stock analysis, you’ll want to familiarize yourself with key technical indicators and chart patterns. These tools can help you navigate the stock’s movements and make more informed trading decisions.

Understanding Moving Averages

When examining GOEV’s chart, pay attention to the moving averages. You’ll typically see the 50-day and 200-day moving averages plotted. These lines can provide insights into the stock’s trend:

- If GOEV is trading above both moving averages, it’s generally considered bullish.

- When the stock price crosses below these averages, it might signal a potential downtrend.

Keep an eye on the “golden cross” (50-day moving above the 200-day) and “death cross” (50-day moving below the 200-day) for potential trend reversals.

Relative Strength Index (RSI)

The RSI is a momentum indicator you’ll want to monitor for GOEV. It oscillates between 0 and 100:

- An RSI above 70 suggests the stock may be overbought.

- An RSI below 30 indicates it might be oversold.

Use this indicator in conjunction with other tools to confirm potential buy or sell signals.

Volume Analysis

Don’t overlook GOEV’s trading volume. Significant price movements accompanied by high volume can validate the strength of a trend. You’ll want to look for:

- Volume spikes during breakouts or breakdowns.

- Divergences between price and volume, which might signal a potential reversal.

Remember, technical analysis is just one piece of the puzzle. Combine these indicators with fundamental analysis and market sentiment to get a more comprehensive view of GOEV’s potential movements.

Key Support and Resistance Levels for GOEV Stock

Understanding Support and Resistance

When you’re analyzing GOEV stock, it’s crucial to identify key support and resistance levels. These levels act as invisible barriers that can influence price movements. Support levels are where buying pressure typically outweighs selling pressure, while resistance levels are where selling pressure tends to overcome buying pressure.

Identifying Current Levels

As you examine GOEV’s chart, you’ll notice several significant price points. Keep an eye on the following levels:

- Support: Watch for buying interest around $0.50 and $0.25. These levels have historically shown strong demand.

- Resistance: Look for selling pressure near $1.00 and $1.50. These areas have previously acted as ceilings for the stock price.

Remember, these levels can shift as new information impacts the market’s perception of GOEV.

Using Levels in Your Analysis

When you’re plotting your trading strategy, consider how GOEV’s price interacts with these levels:

- Bounces off support might signal buying opportunities.

- Rejections at resistance could indicate potential short-term tops.

- Breakouts above resistance or breakdowns below support may suggest new trends forming.

Always combine this analysis with other indicators and fundamental research for a comprehensive view.

Dynamic Nature of Support and Resistance

Keep in mind that support and resistance levels aren’t set in stone. As GOEV’s business evolves and market conditions change, these levels may shift. Stay updated on company news and broader market trends to adjust your analysis accordingly. Regular chart reviews will help you spot emerging patterns and potential new support or resistance zones.

Conclusion

As you navigate the GOEV Stocktwits forum and analyze Canoo’s momentum, remember to keep a balanced perspective. While the excitement around Canoo’s innovative designs and potential partnerships is palpable, it’s crucial to weigh the risks alongside the rewards. Stay informed by regularly checking stock charts, following expert analyses, and monitoring industry trends. Your investment strategy should align with your personal financial goals and risk tolerance. By staying engaged with the Stocktwits community and conducting thorough due diligence, you’ll be better equipped to make informed decisions about GOEV stock. Keep your finger on the pulse of Canoo’s progress, and may your investment journey be a successful one.