How to Find Muln Stocktwits Conversations and Analysis

Navigating the world of stock discussions can be daunting, especially when you’re looking for specific conversations about MULN on Stocktwits. Fear not, fellow investor! This guide will be your compass, helping you chart a course through the sea of chatter to find the most valuable MULN insights. You’ll discover how to efficiently locate and filter MULN-related posts, engage with other traders, and uncover hidden gems of analysis. Whether you’re a seasoned Stocktwits user or just dipping your toes in the water, you’ll soon be sailing smoothly through MULN discussions like a pro.

An Introduction to Muln Stocktwits

What is Muln Stocktwits?

As you dive into the world of stock trading and analysis, you’ll find Muln Stocktwits to be an invaluable resource. It’s a platform where investors, traders, and enthusiasts gather to discuss and share insights about Mullen Automotive Inc. (MULN) stock. Think of it as a social media hub specifically tailored for MULN stockholders and those interested in the company’s performance.

Navigating the Platform

When you first land on Muln Stocktwits, you’ll notice a stream of real-time messages, or “twits,” from users. These posts often include:

- Price predictions

- Technical analysis

- News updates

- Sentiment indicators

To make the most of your experience, you’ll want to familiarize yourself with the platform’s features. Look for the search bar to find specific topics or users, and use the filters to sort messages by popularity or recency.

Engaging with the Community

As you explore Muln Stocktwits, you’ll have the opportunity to engage with other users. Here’s how you can participate:

- Create an account to post your own messages and analysis

- Follow influential users for consistent insights

- Use cashtags (e.g., $MULN) to tag your posts about the stock

- Contribute to discussions by replying to other users’ messages

Remember, while Muln Stocktwits can be a goldmine of information, it’s crucial to approach the platform with a critical eye and always conduct your own research before making investment decisions.

Finding Muln Conversations and Sentiment on Stocktwits

Navigating to Muln’s Stocktwits Page

To find Muln conversations on Stocktwits, start by heading to the Stocktwits homepage. In the search bar at the top, type “MULN” and hit enter. You’ll be directed to Mullen Automotive’s dedicated page, where you can find real-time discussions and sentiment analysis.

Exploring the Conversation Stream

Once on Muln’s page, you’ll see a stream of posts from other users. Scroll through to get a feel for the current buzz around the stock. You can filter posts by clicking on “Trending,” “Latest,” or “Top” to view the most popular or recent conversations.

Analyzing Sentiment Indicators

Pay attention to the sentiment indicators next to each post. You’ll notice bull (positive) or bear (negative) icons, giving you a quick visual cue about the overall mood. For a broader view, check the sentiment chart at the top of the page, which shows the percentage of bullish vs. bearish posts over time.

Engaging with the Community

To dive deeper, consider joining the conversation. Click on interesting posts to view replies and add your own thoughts. Remember to use the cashtag $MULN in your posts to ensure they appear in the main feed. This engagement can help you gauge investor sentiment and potentially uncover valuable insights about Mullen Automotive’s stock performance and outlook.

How to Analyze Muln Stocktwits Data and Sentiment

Understanding Stocktwits Data

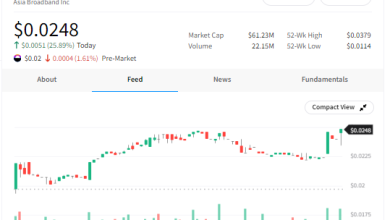

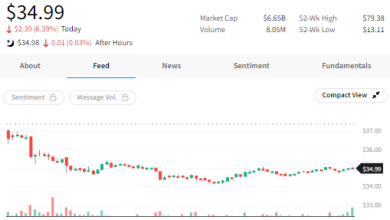

To analyze Muln Stocktwits data effectively, you’ll need to understand the platform’s unique features. Stocktwits provides real-time conversations and sentiment indicators for stocks like Mullen Automotive (MULN). Start by familiarizing yourself with the platform’s interface and the types of data available, such as message volume, bullish/bearish sentiment, and trending topics.

Interpreting Sentiment Indicators

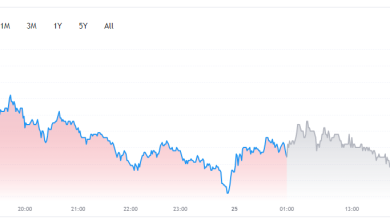

Pay close attention to the sentiment indicators on Stocktwits. These typically appear as bulls (positive) or bears (negative) next to messages. You can gauge overall sentiment by looking at the ratio of bullish to bearish messages over time. Remember that sentiment can shift rapidly, so it’s crucial to monitor these indicators regularly.

Analyzing Message Volume and Trends

Message volume can be a powerful indicator of interest in MULN stock. Look for spikes in activity, which often correlate with significant news or price movements. You should also track trending topics and hashtags related to MULN. These can provide insights into what’s driving the conversation and potentially influencing stock performance.

Combining Stocktwits Data with Other Sources

For a comprehensive analysis, don’t rely solely on Stocktwits data. Combine this information with other sources such as:

- Financial news articles

- Company press releases

- Technical analysis charts

- Fundamental data

By integrating multiple data points, you’ll gain a more holistic view of MULN stock sentiment and potential market movements.

Conclusion

As you navigate the world of MULN Stocktwits, remember that staying informed is key to making smart investment decisions. By following the steps outlined in this guide, you’ll be well-equipped to find and engage with relevant conversations, track sentiment, and gather valuable insights. Keep in mind that while Stocktwits can be a great resource, it’s important to cross-reference information with other reliable sources. As you become more familiar with the platform, you’ll develop your own strategies for filtering through the noise and identifying the most useful discussions. Happy investing, and may your MULN stock journey be a prosperous one!